dv01 Prime and Subprime Auto BenchmarksStreamline Your Auto ABS Analysis with dv01

Analysis-Ready Data

Strategic Benchmarking

Precision Insights

Drive Your Auto Strategy Forward with Analysis-Ready Auto ABS Data

Accessing public auto ABS data is one thing; extracting actionable insights from it is another. This data is typically unrefined—dirty, unstructured, and burdensome to process. dv01 transforms this complex landscape with its Prime and Subprime Auto Benchmarks.

The auto benchmarks consolidate loan-level data from all public auto ABS data issuers accessible via EDGAR, delivering it as clean, structured, and analysis-ready. The streamlined access saves you time and costs, and enhances the accuracy of your insights and agility of your business strategy.

Maximize Insights, Minimal Data Management

dv01 eliminates the complexity of data management. We handle all aspects of data aggregation and preparation, freeing up your time to focus on strategic decision-making.

Comprehensive Data Coverage

dv01’s extensive data aggregation—both Prime and Subprime auto loans—includes a wide range of credit performance metrics, such as delinquency rates, prepayment speeds, loss severity, and much more. dv01’s rigorous data cleaning and validation processes deliver high-quality, reliable information, crucial for precise market analysis.

Monthly Updates

Stay ahead of the market with real-time data updates. As new Auto ABS data becomes available, it is immediately processed and integrated into our platform, giving you the most current insights.

Advanced Analytics at Your Fingertips

dv01’s embedded analytical tools enable you to dissect and understand loan performance and collateral quality without needing multiple IT vendors or relying strictly on Excel. For more custom analysis, users can access the standardized data through SFTP files or SQL and connect it to existing data reporting workstream.

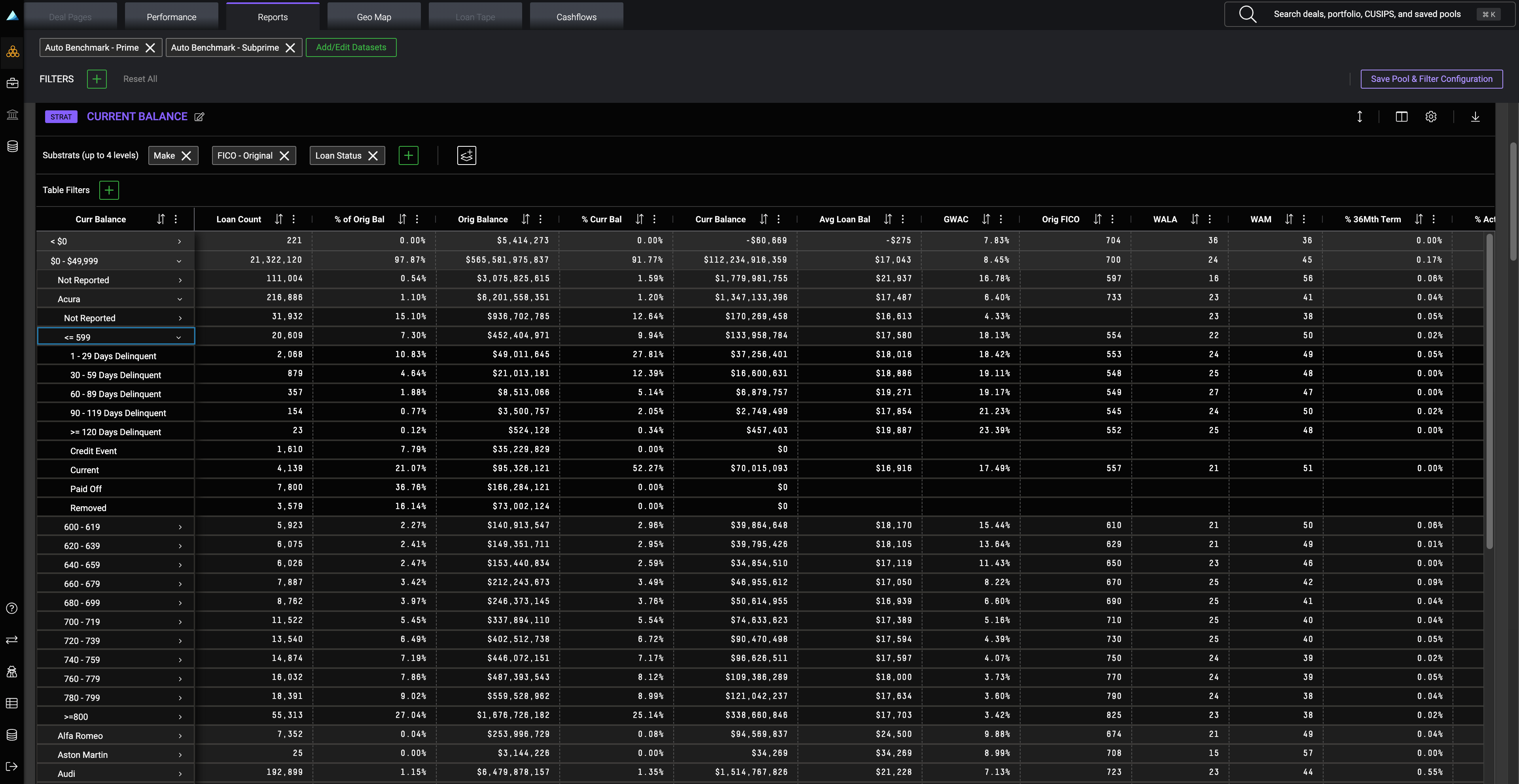

Detailed Collateral Insights

Create layered risk profiles and detailed pivot tables to examine Prime and Subprime auto loans, revealing critical lending dynamics and borrower profiles.

Monitor Origination Trends

Track how origination volumes reflect broader market movements, identify growth opportunities, and mitigate risks to maintain a competitive and adaptive portfolio.

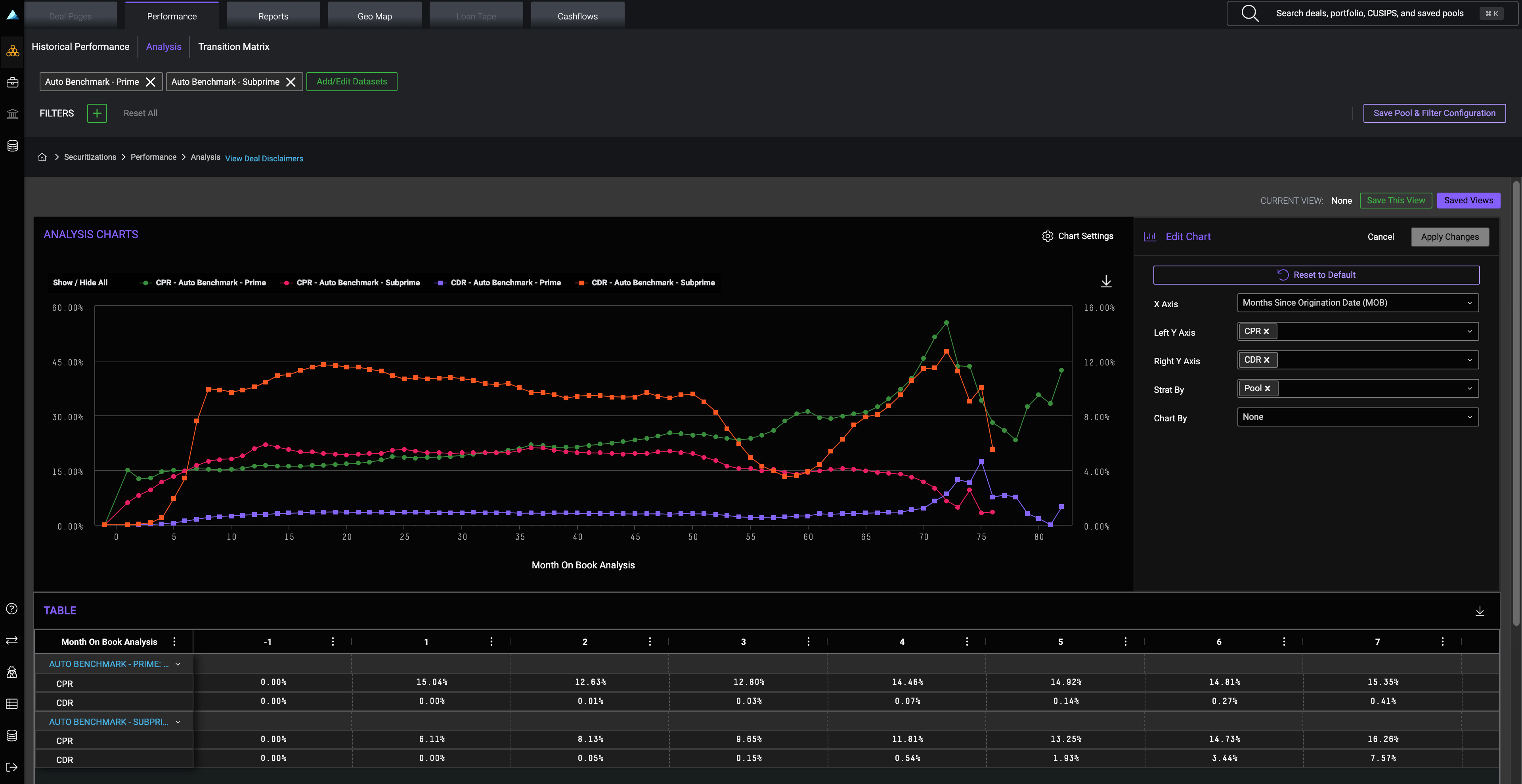

Analyze Performance Drivers

Dive deep into key performance indicators such as prepayment rates, delinquency incidents, and overall credit quality. Chart performance for detailed analysis, giving you a clear view of trends and cycles.

Competitive Edge

Deepen your market analysis with advanced analytics and comparisons against industry benchmarks, identifying untapped opportunities. Adjust your strategies to better align with market conditions, optimizing your investment outcomes.