Loan Data Agent for Securitizations and Private CreditBoost Transparency and Confidence in ABS and RMBS Transactions

Access Standardized Loan-Level Data

Streamline Reporting Processes

Boost Market Transparency

Elevate Your Reporting Operations

Simplify your reporting operations with dv01’s modern solution, designed to replace error-prone, manual workflows. By automating the data preparation and reporting processes, dv01 ensures data accuracy and provides standardized loan-level insights, empowering both issuers and investors to focus on decision-making with confidence.

Modern data-first infrastructure

dv01’s flexible data infrastructure accepts data from servicers, issuers, and originators in a variety of formats and transforms it into a standard format, allowing us to guarantee data integrity throughout the lifecycle of a deal.

Data Quality Checks

All onboarded transaction data is protected by a series of comprehensive validations that are applied at various stages in the data pipeline process.

Up-to-Date Performance Data

By establishing a direct data pipeline with loan providers, dv01's streamlined ETL process provides stakeholders fast access to performance data.

Fully integrated analytics

By leveraging world-class analytics tools, stakeholders can extract actionable insights on collateral composition and performance in seconds.

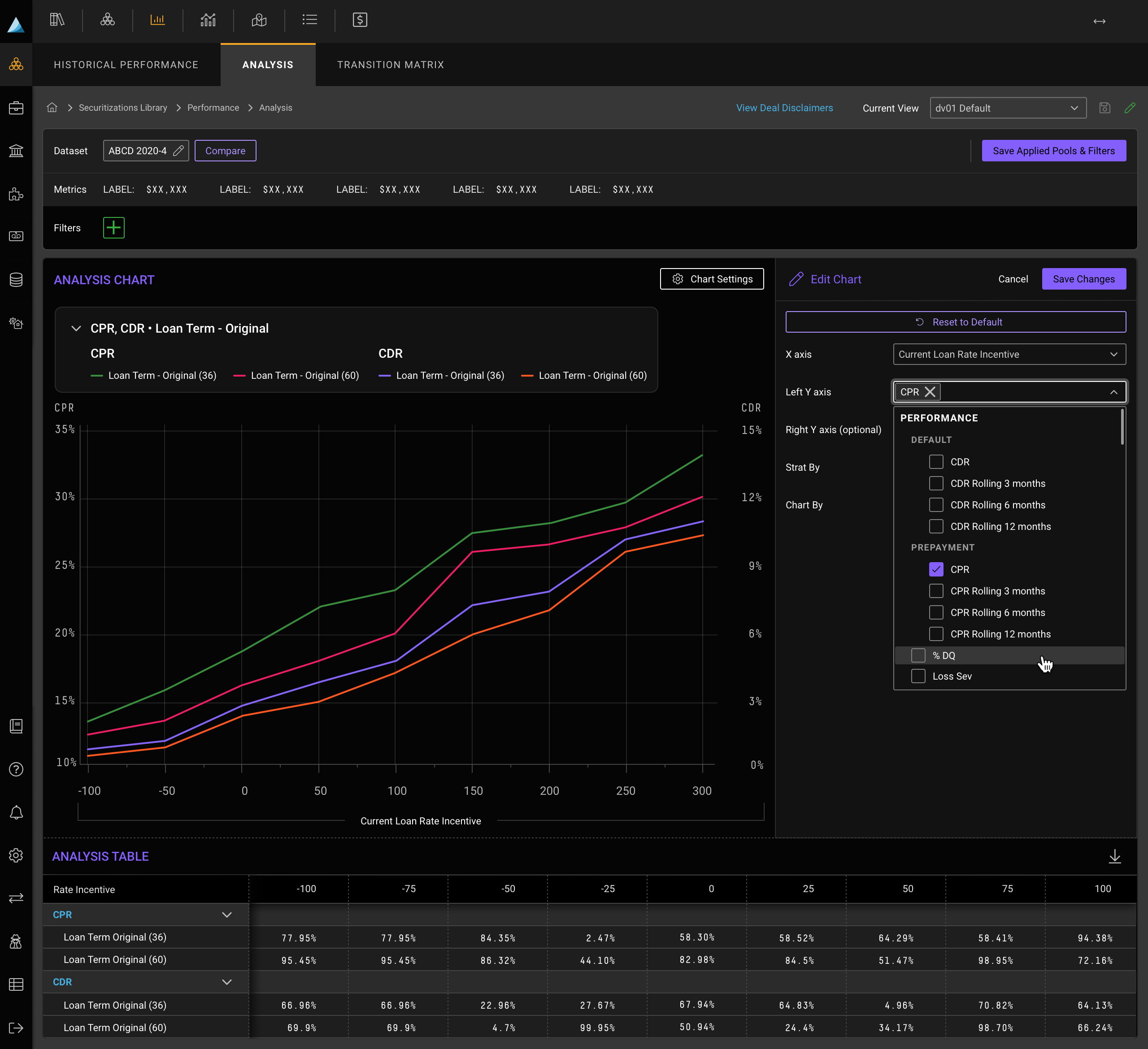

Interactive Performance Charts and Tables

Analyze historical performance for the collateral pool and all tranches, as well as historical prepay and delinquency trends, by loan age and deal age. Even more, examine the movement of loans across delinquency statuses.

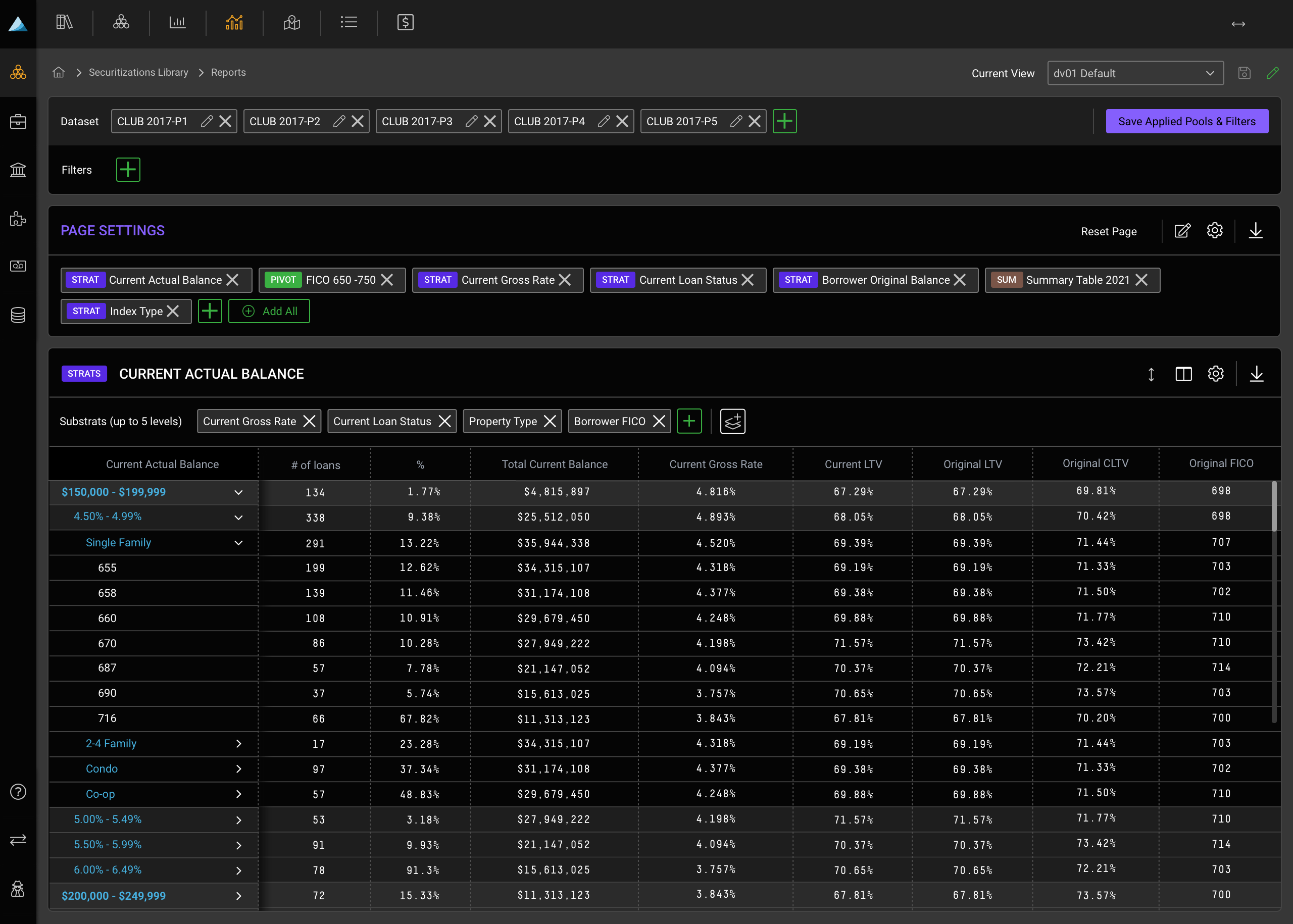

Reporting Tools

Visualize data by any loan field to drill into the specifics and identify patterns easily through pivot, strat, and summary tables.

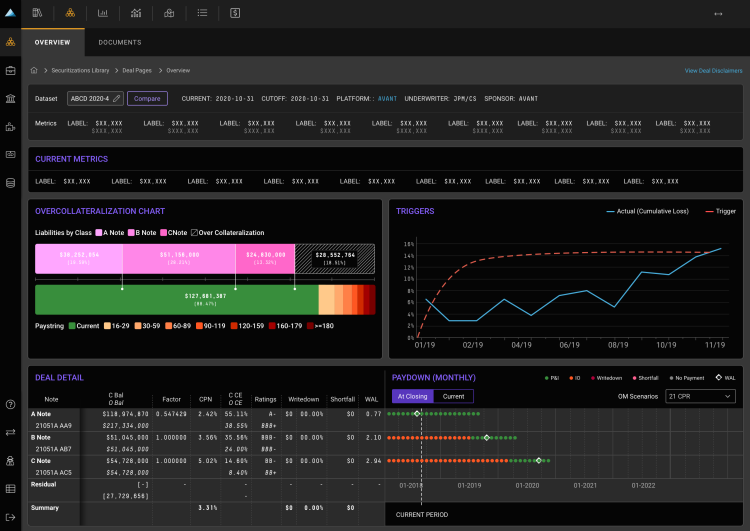

Built-In Cashflow Engine

Determine loan performance assumptions, including prepayments, delinquencies, and defaults, to forecast cashflow under multiple scenarios.

Geo Map

Visualize where loan clusters exist across the U.S. based on loan attributes, including percent of loans actively modified, loan count, and average FICO.

Automate administrative tasks

With over 400 leading institutional investors on the dv01 platform, issuers can easily provide investors access to historical performance for previous deals.

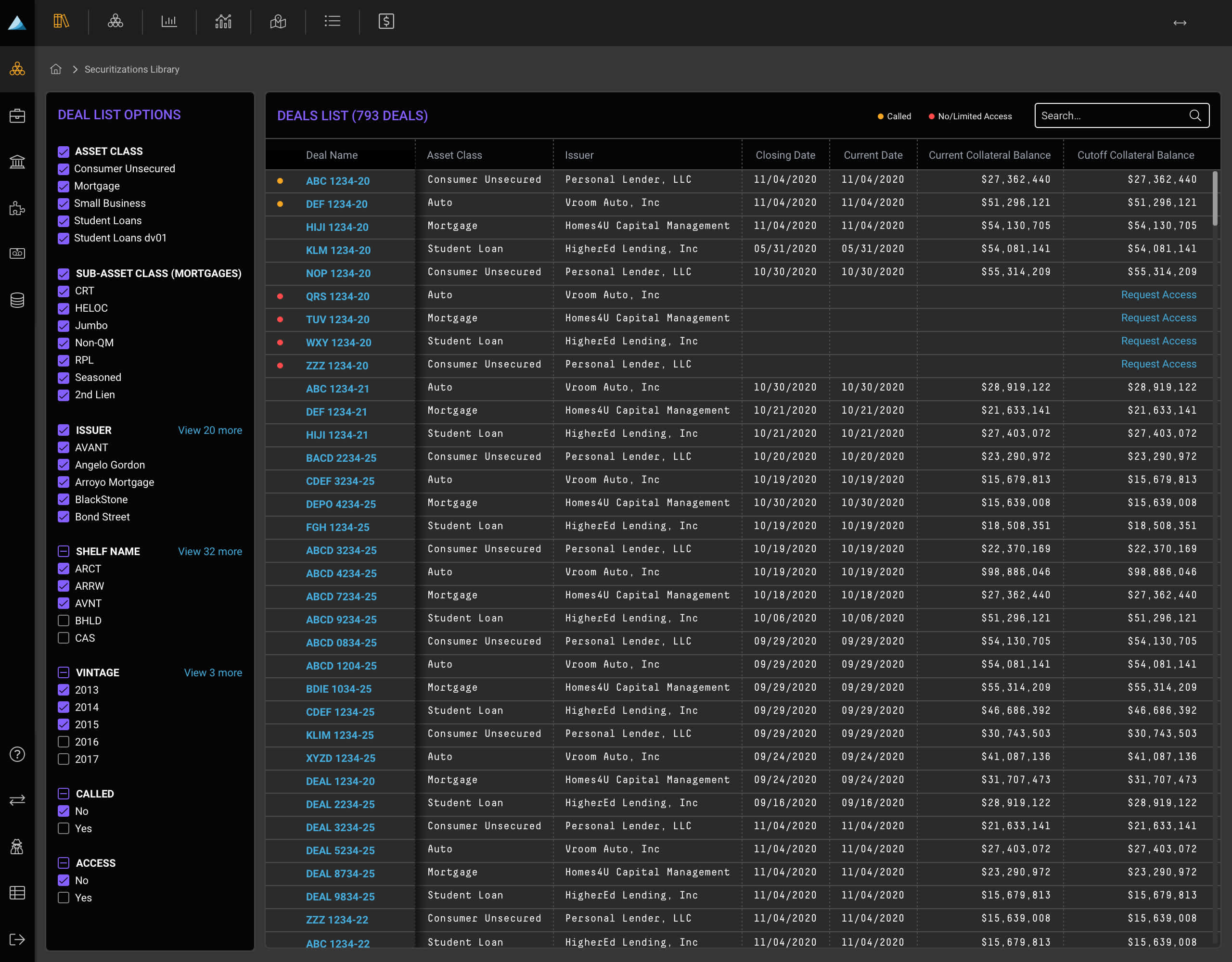

Handle Deal Access Requests Efficiently

Participating investors are automatically enrolled to the loan-level data and can request access to additional deals directly through the platform.

Centralized Transaction Information

Review a summary of all accessible deals, with essential deal information including closing date, originator, underwriter, remaining collateral balance, and more.