Market SurveillanceKeep a Pulse on Consumer Credit

Access Extensive Coverage

Discover Opportunities

Measure Issuer Performance

Data intelligence for due diligence

Determine opportunities worth pursuing. Market Surveillance offers extensive coverage of non-QM, prime jumbo, CRT (CAS and STACR), consumer unsecured, point of sale, small business, and student loans. Even more, users can access consumer credit benchmarks for a comprehensive overview of specific asset classes.

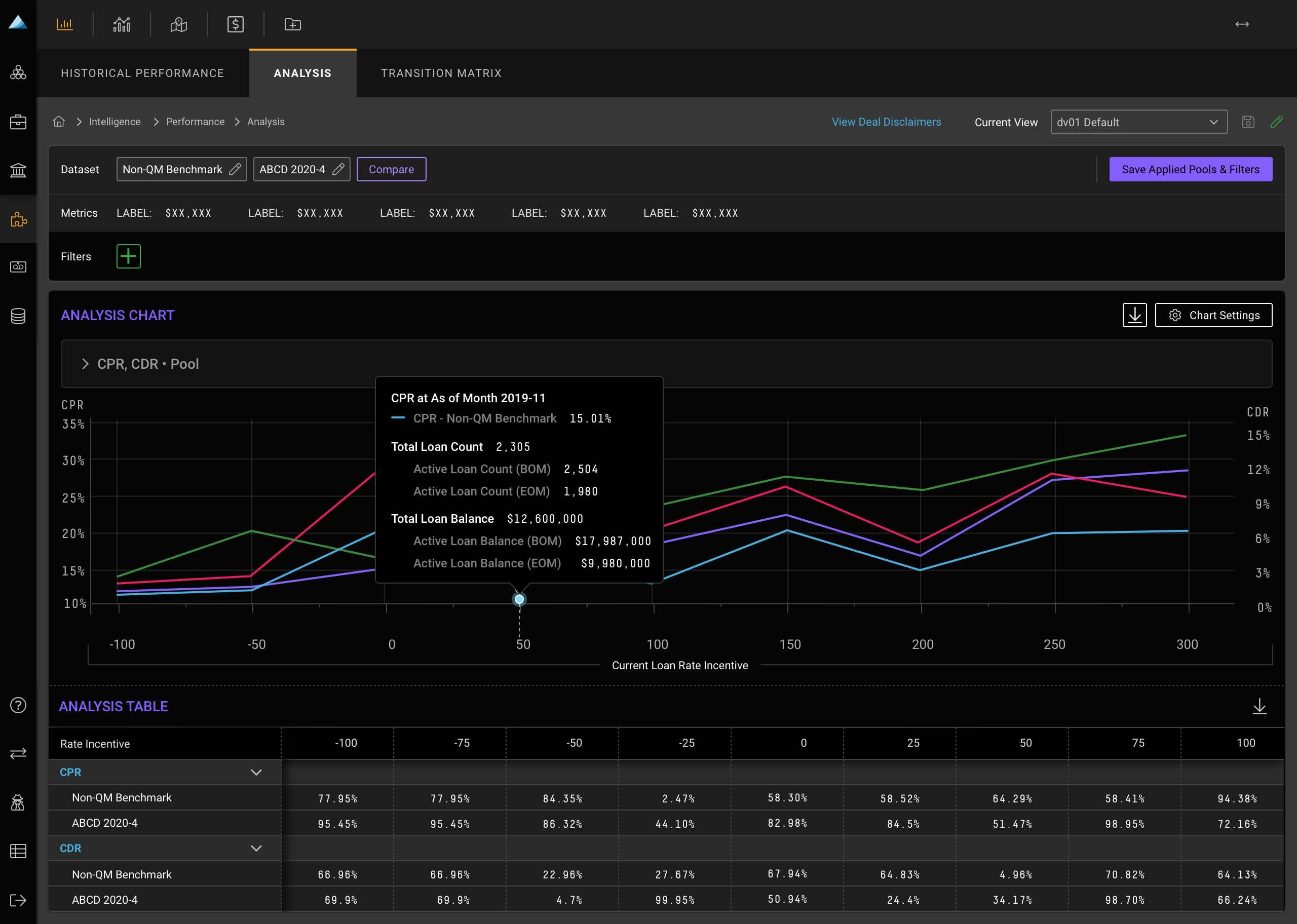

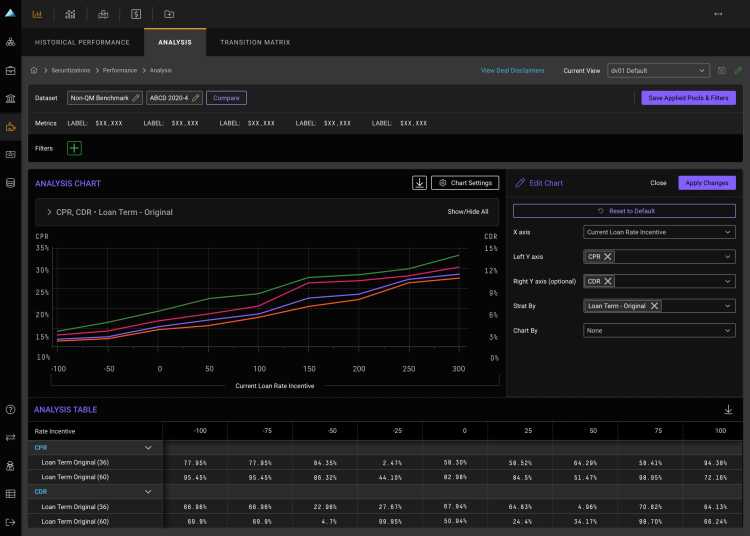

Explore analysis-ready data in seconds

Harnessing a suite of built-in visualization tools, users can now answer questions involving collateral composition, performance metrics, and credit metrics.

Leverage a Comprehensive Reporting Toolkit

Review loan performance, analyze trends, generate multi-scenario cashflow projections in a matter of seconds.

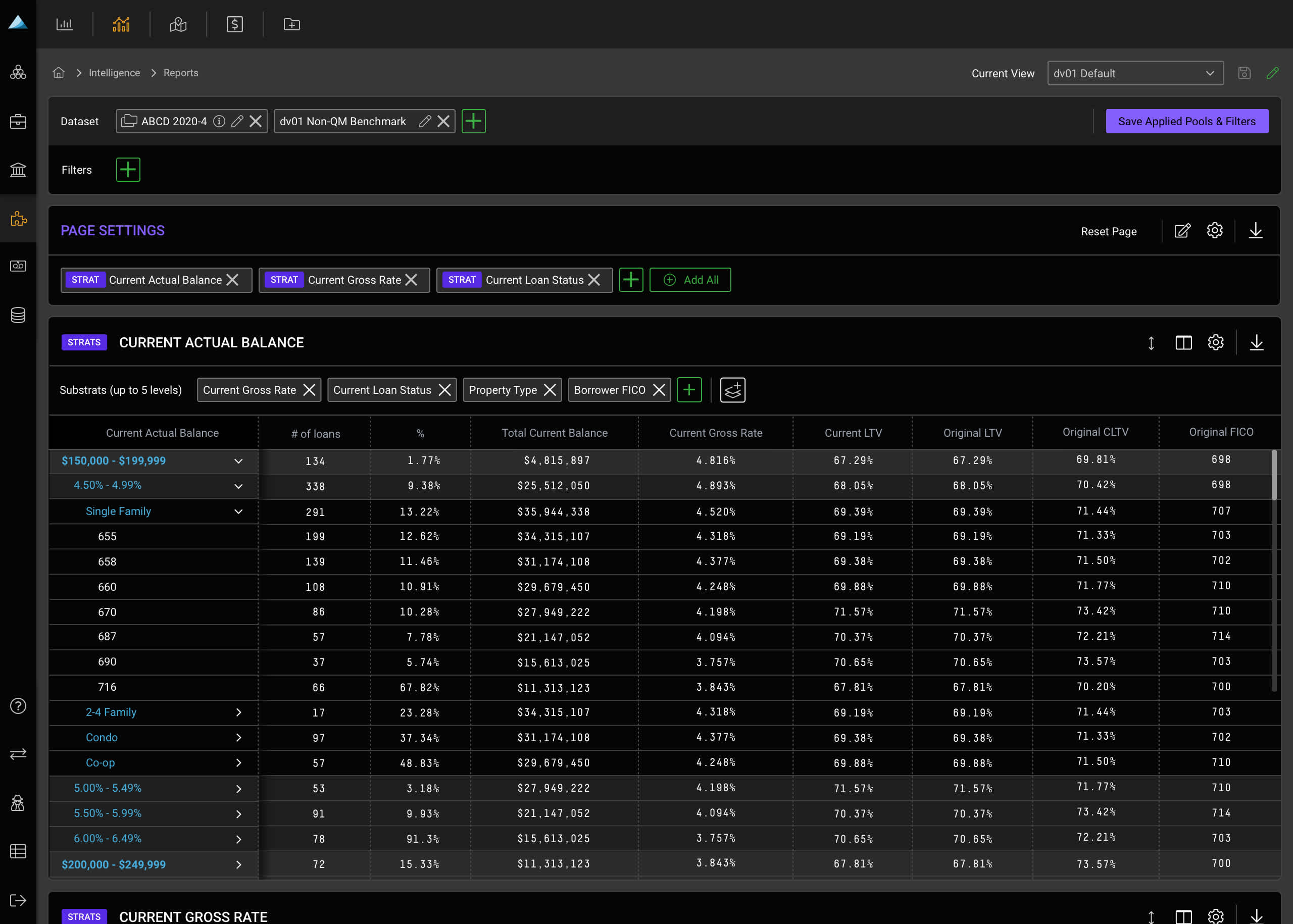

Dissect the Collateral

Visualize data by any loan-level metric to drill into the specifics and identify patterns easily through pivot, strat, and summary tables.

Monitor the health of the U.S. consumer through industry benchmarks

dv01 anonymizes datasets available on our platform, allowing clients to gain a holistic view of consumer unsecured, non-QM and prime jumbo mortgages, and prime and subprime auto markets.

Identify relevant loan characteristics within each asset class

Easily uncover performance insights based on collateral attributes and trends.

Track the effects of consumers in distress

Assess the impact of hardship relief plans by diving into loan modification data, such as type, start date, and reason.