Help Innovate Wall Street’s Tech Stack

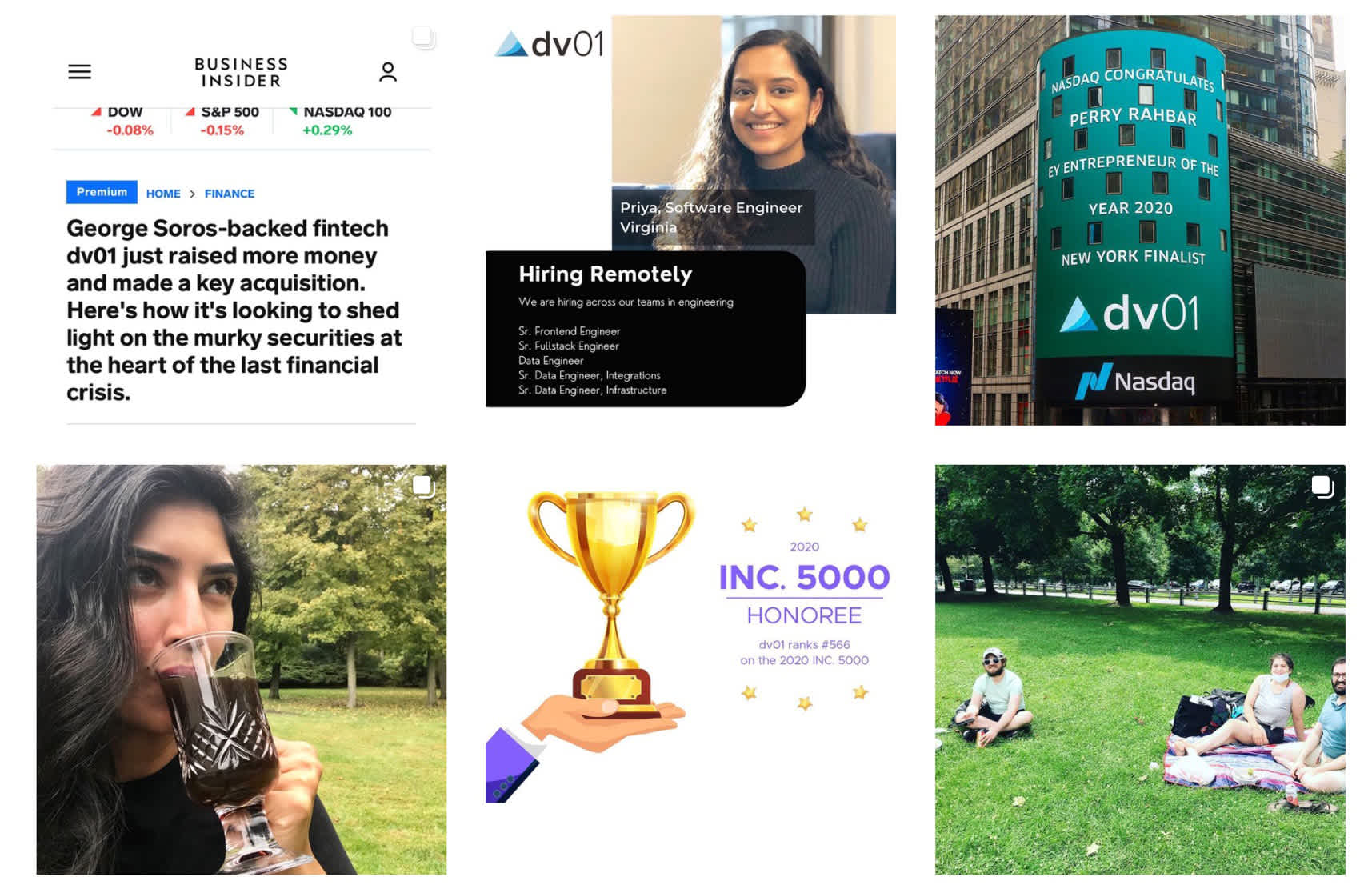

The Future of Work at dv01

Navigating the job market is tough in the best of circumstances, and a global pandemic has now fundamentally changed the way we work and live. dv01 met that challenge by successfully transforming into a 100% remote-first company. Simply put, the safety of our employees and their families is our top priority, and we're in no rush to bring team members back onsite.

As we look toward the future, we will offer team members the flexibility to choose where they work—whether that is the dv01 office, at home, or within a hybrid model. When joining dv01, you can trust that we have your safety and career growth in mind.

Perry Rahbar

dv01 Founder and CEO

Life at dv01

Championing market transparency requires people who challenge the status quo. We are dreamers, thinkers, and doers that are passionate about learning and getting things done. We foster a safe environment where you are challenged, encouraged, and rewarded. To get a better idea of what a year at dv01 looks like, check out our Year in Review: 2018, 2019, 2020, 2021, and 2022.

Overheard at dv01

Belief in dv01

I believe in the future and mission of the company

94%

Agree

Impact

I feel my work is important to the success of the company

96%

Agree

Flexibility

I have the flexibility to work the hours and schedule that gives me balance

96%

Agree

Perks and Benefits

Camaraderie

- In-Person Team Building Events & Annual Company Offsite

- Peer Recognition program

- Virtual Coffees & Hangouts

- Remote Work with Office Space in New York

- Cultural Awareness and Impact Events

Wellness

- Free All-Access Equinox Pass or Health and Wellness Stipend

- In-house Personal and Performance Development Coach

- Virtual Team Workouts

- Nearly 100% Paid Health Insurance

- Unlimited PTO

- Free One Medical Membership

Career Growth

- Entrepreneur Panel Discussions

- Lunch & Learns

- Prototype Days

- Learning and Development Allowance

Compensation

- Above-Market Salary

- 401(k) Plan via Guideline