Blog

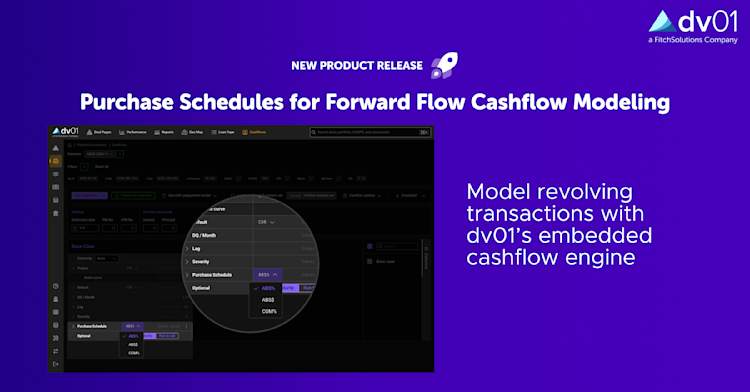

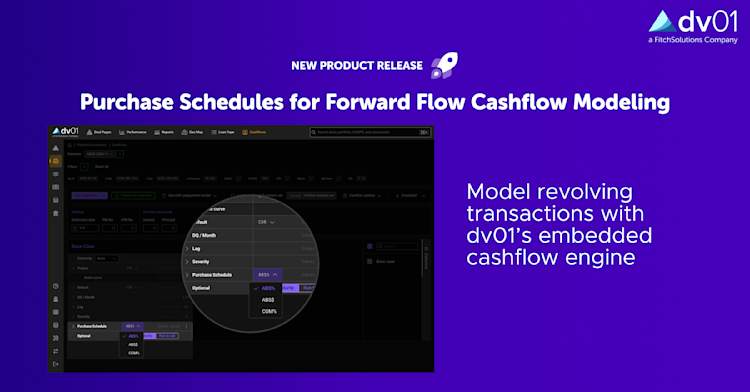

Powering Forward Flow Transactions with Purchase Schedules

22 September 2025

Powering Forward Flow Transactions with Purchase Schedules

Forward flow and other private transactions are inherently dynamic. Unlike static securitizations, these transactions require participants to anticipate and manage continuous loan purchases, shifting balances, and evolving collateral profiles. Success depends on the ability to model not just what’s in the pool today, but in the subsequent periods as more loans are added.

dv01 has enhanced its cashflow engine with purchase schedules, enabling users to model how much new principal enters each month. You can learn more about it here.

Modeling Growth with dv01’s Embedded Cashflow Engine

Whether the structure involves adding a fixed-dollar or percentage amount to the initial balance or adding a percent to the current balance each month, dv01 now makes it possible to simulate these commitments directly within our cashflow engine:

Fixed-dollar commitments — e.g., a forward flow agreement to purchase $10M of student loans over 18 months.

Percentage-based growth — committing to acquire 5% more of the original balance of residential mortgages from an originator over six months.

Compounding paths — modeling an auto portfolio where new purchases grow by 2% of the current balance each month.

By capturing these dynamics, dv01 extends cashflow projections beyond static assumptions, providing a more realistic view of how forward flow and ABF portfolios evolve over time.

Why It Matters for Forward Flow

With purchase schedules, investors and issuers gain:

Accurate projections of portfolio balances and tranche cashflows for 4a2 transactions or securitizations.

Better structuring, with the ability to model expected pool composition.

In short: forward flow transactions can be modeled and managed with confidence and ease.

dv01: Beyond Purchase Schedules

Supporting flexible purchase schedules is valuable, and they’re just one part of dv01’s broader forward flow workflow. We provide:

Data transformation: Clean, standardized loan tapes from originators.

Facility reporting: Borrowing base and advance rate tracking against credit agreements.

Cashflow projections: Powered by dv01’s engine, capturing prepayments, defaults, and now, dynamic purchases.

Ongoing monitoring: Portfolio surveillance and benchmarking to keep both sides aligned. We can also deliver monthly servicing reports on behalf of originators.

dv01 will continue to enhance its infrastructure to support the evolving needs of forward flow and ABF, ensuring clients have the transparency, rigor, and efficiency required as these transactions grow in prominence.

Why Work with dv01?

With purchase schedules enhancing our cashflow engine—and with data transformation, facility reporting, and ongoing monitoring already core to our platform—dv01 delivers infrastructure for structuring and managing forward flows.

If you’re investing in or structuring forward flow deals, partner with dv01 to ensure your transactions are modeled, monitored, and managed with confidence. Contact us here.

RELATED POSTS

What Verification Really Means (and What It Doesn’t)

4 December 2025