Blog

The Rise of Forward Flows and ABF in Private Credit

2 September 2025

The Rise of Forward Flows and ABF in Private Credit

Forward flow and other asset-backed finance (“ABF”) structures are becoming central to private credit. Issuers rely on them for predictable funding, while investors use them to scale exposure to consumer and specialty finance assets.

Unlike static securitizations, these transactions are inherently dynamic — portfolios evolve month after month as new collateral is purchased and performance unfolds. That dynamism is what makes forward flows and ABF attractive, but it also makes them complex.

dv01 is best known for powering securitizations, but our data infrastructure and expertise extends wherever our clients need it—whether that’s with whole loan purchases or warehouse reporting. Increasingly, that means powering private credit and ABF. Our existing capabilities already support most needs of ABF transactions, and we’re investing in enhancing them to address the unique requirements of forward flow agreements, credit facilities, and other ABF transactions.

The Challenge of Dynamic Portfolios

In forward flow and ABF transactions, success depends on more than the initial agreement. Loan pools don’t remain fixed; they grow and shift with each new delivery. Over time, those changes alter risk exposure, repayment timing, and advance rates.

For investors, this means underwriting isn’t a one-time exercise. They need projections that reflect rolling originations, and ongoing reporting that builds confidence long after closing.

For issuers, it means reconciling origination data with facility terms and eligibility criteria on a recurring basis, and doing so with accuracy and efficiency.

Without the right infrastructure, these requirements quickly become operationally heavy and prone to error.

Why Infrastructure Matters for Forward Flow and ABF

Forward flow and ABF transactions demand more than technology alone or structured finance knowledge in isolation. Market participants need infrastructure that brings the two together:

Clean, standardized loan-level data to eliminate manual tape wrangling.

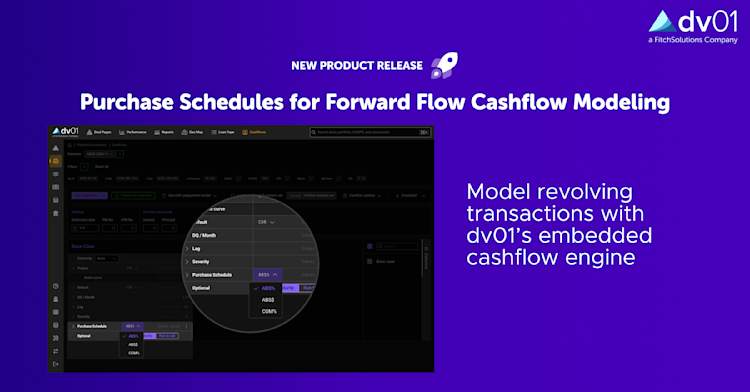

Accurate modeling that reflects how portfolios evolve as new loans are purchased and repaid.

Automated reporting to align borrowing bases, advance rates, and compliance requirements.

Ongoing monitoring and benchmarking to keep issuers and investors aligned over time.

This combination of structured finance expertise and modern technology is why issuers and investors already trust dv01 to manage securitizations — and why we’re the natural partner for forward flow and ABF.

Looking Ahead: Forward Flow and ABF as Complements to Securitization

Forward flow and ABF transactions aren’t replacing securitizations — they’re complementing them as the market evolves. But their success depends on infrastructure that can manage dynamic portfolios with the same rigor and transparency the market already expects from securitizations.

dv01 is uniquely positioned to deliver that. Trusted in securitization, proven in data, and focused on end-to-end workflows, we’re helping market participants scale forward flow and ABF with clarity, efficiency, and confidence.

If you’re structuring or investing in forward flow and ABF transactions, partner with dv01 to bring securitization-grade rigor and modern infrastructure to every stage of your workflow. Contact us to discuss.

RELATED POSTS

What Verification Really Means (and What It Doesn’t)

4 December 2025