Blog

Why Student Loan Balances Keep Rising Even as Loan Counts Fall

18 August 2025

The student loan market has entered a new phase—one where portfolio size and portfolio count no longer move in lockstep.

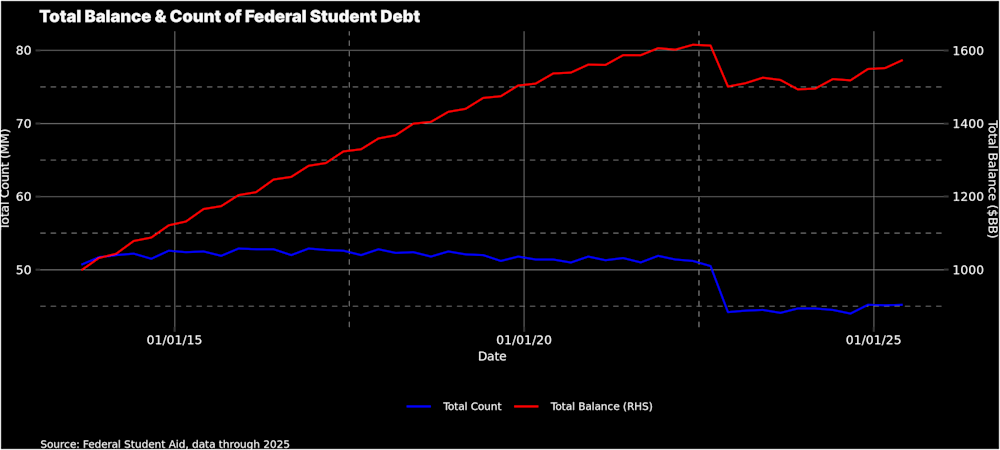

According to Federal Student Aid data, between 2015 and 2022, outstanding federal student loan balances grew by roughly 33–34%, even though the number of loans remained flat. Since repayments resumed in late 2022, loan counts have fallen by more than 10%, yet balances have started to climb again.

The IDR Effect

A key reason for this divergence is the widespread use of Income-Driven Repayment (“IDR”) plans:

55–60% of balances in repayment are under IDR, but these loans represent only about 40% of total loan count.

Under IDRs, principal amortization is often limited unless a borrower’s income grows significantly, keeping balances elevated for years.

Borrowers not in IDR — typically with smaller balances — tend to pay down debt faster, reducing their share of the outstanding balance over time.

This creates a portfolio composition that is slower to amortize, with larger average balances, even in a shrinking loan universe.

Not Just About Rising Tuition

While education costs have increased over the past decade, the growth in aggregate balances has outpaced average debt at graduation by roughly 50%. The implication: structural repayment patterns, not just origination size, are driving much of the balance persistence.

Why This Matters

For Issuers:

Slower principal paydown changes the shape of cashflows and the story you share with investors.

Portfolios may remain larger for longer, even without significant new origination.

Clear communication about repayment structures, cohort behavior, and balance composition becomes critical for investor relations.

For Investors:

A high proportion of non-amortizing loans alters expected repayment speeds and portfolio seasoning.

Evaluating pools requires deeper context around repayment plans and borrower profiles to accurately model risk and returns.

How dv01 Fits In

At dv01, we work with issuers to streamline loan data management, enhance investor reporting, and deliver insights that strengthen portfolio positioning. Our platform and embedded tools help improve capital markets operations while ensuring loan-level data is accurate, consistent, and ready for analysis.

For investors, we deliver embedded analytics and analysis-ready data, with timely access to performance trends, repayment behaviors, and cohort analysis—empowering better evaluation and portfolio management decisions.

Whether you’re issuing or investing in student loan portfolios, let’s discuss how dv01 can help improve your workflow.

RELATED POSTS

What Verification Really Means (and What It Doesn’t)

4 December 2025