Press

Fitch Ratings Releases U.S. RMBS Model on dv01’s Web Interface, Enhancing Usability and Streamlining Workflows

6 October 2025

Fitch Ratings Releases U.S. RMBS Model on dv01’s Web Interface, Enhancing Usability and Streamlining Workflows

NEW YORK, Oct 6, 2025 – Fitch Ratings, one of the world’s largest credit ratings agencies and dv01, a leading capital markets fintech driving technological innovation and loan-level transparency in structured finance, today released the Fitch U.S. RMBS Ratings Model on dv01’s web interface.

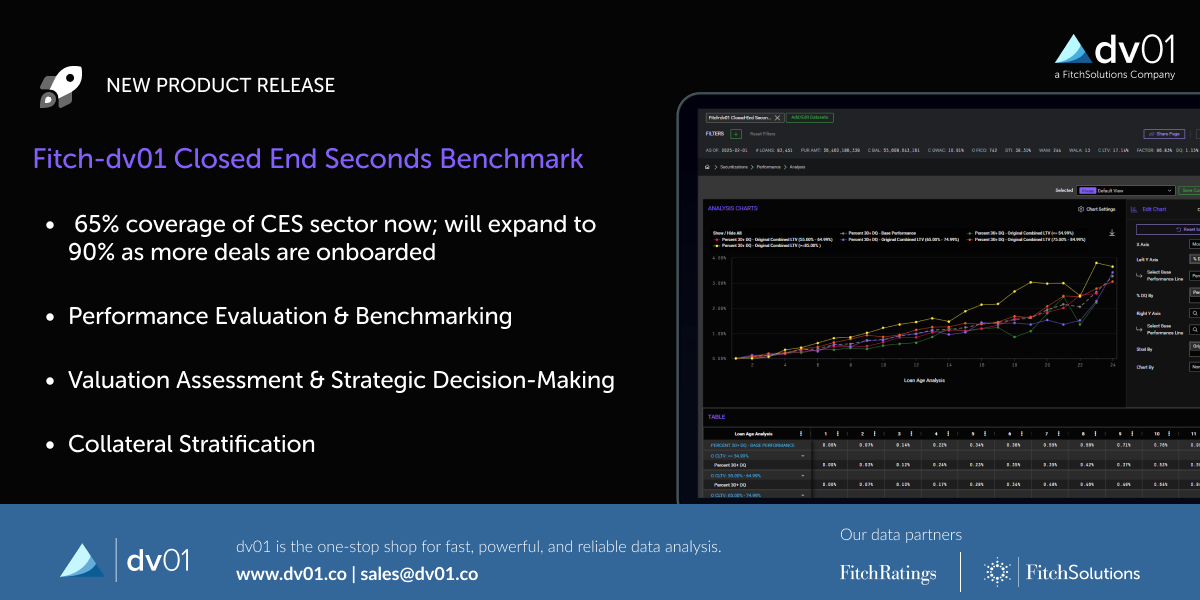

Modernized from a historical Excel file, the model now offers a streamlined, interactive workflow within dv01, improving usability, transparency, and scalability for RMBS issuers and investors. This marks the third initiative jointly introduced by dv01 and Fitch Ratings—following co-branded RMBS benchmarks and interactive RMBS presale reports—and underscores Fitch Group’s commitment to combining rigorous credit analysis and market transparency with innovative technology.

“Since dv01 became part of Fitch Group, we’ve been working together to combine Fitch’s credit expertise with dv01’s technology to transform how structured finance participants interact with data and models,” said Perry Rahbar, Founder & CEO of dv01. “Delivering the Fitch U.S. RMBS Ratings Model through our platform is a significant milestone on that path—giving issuers and investors faster access, greater transparency, and a more efficient workflow.”

Powered by dv01’s Tape Cracker, which uses machine learning to convert data from raw collateral tapes into Fitch’s preferred schema, the process streamlines data mapping and cleansing. Once formatted, the Fitch U.S. RMBS Ratings Model is applied to the dataset, appending preliminary outputs based on Fitch’s latest criteria for loan-level performance, expected losses, and credit enhancement requirements.

“The launch of Fitch Ratings’ U.S. RMBS Model via dv01’s Tape Cracker interface combines Fitch’s analytical rigor with dv01’s innovation in one seamless platform,” said Kevin Kendra, Managing Director and Head of North America RMBS, Fitch Ratings. “This integration streamlines issuer workflows, enhances alignment with Fitch’s assumptions, and ultimately makes our credit views more accessible and transparent to the structured finance market.”

Key benefits include:

Workflow Efficiency: Automated ingestion, validation, and modeling streamline securitization preparation, reducing manual work and accelerating time-to-market.

Alignment with Fitch’s Expectations: Running the model within dv01 provides clarity on Fitch’s assumptions, fostering more productive engagement during the ratings process.

Interactive Visualization: Dynamic analyses allow for a deeper understanding of Fitch’s credit risk views and how collateral aligns with expected loss assumptions.

Fitch and dv01 will continue to enhance this model-platform integration to further improve usability and insight for market participants. Future iterations will introduce performance attribution analytics to identify key loss drivers, customizable cross-portfolio reporting tools, and stronger data management controls that reinforce governance and efficiency. The model is now available within dv01 for RMBS issuers, bankers, and investors. For more information visit https://www.fitchratings.com/structured-finance/rmbs/loan-loss-model, and request access at www.dv01.co.

dv01 is a subsidiary of Fitch Solutions. Fitch Solutions and Fitch Ratings are both subsidiaries of Fitch Group.

About dv01

dv01 is a capital markets fintech company driving technological innovation and loan-level transparency in structured finance. As the first end-to-end data management, reporting, and analytics platform built for loan-level lending data, dv01 brings clarity and intelligence to every loan for every stakeholder. With over 240 million loans, 1,300 securitizations, and $6 trillion in original balance across consumer, mortgage, auto, student loan, point of sale, home efficiency, and small business asset classes, dv01 aims to build the most comprehensive loan data library in the market. dv01 is a subsidiary of Fitch Solutions.

About Fitch Ratings

As one of the world's largest credit ratings agencies, Fitch Ratings plays a critical role in global capital markets by providing credit analysis, ratings, research, and commentary to financial market participants. For over 100 years, Fitch Ratings has been creating value for global markets through its rigorous analysis and deep expertise, which have resulted in a variety of market leading tools, methodologies, indices, research, and analytical products. Fitch Ratings is part of Fitch Group, a global leader in financial information services with operations in 30 countries, which also includes Fitch Solutions. With dual headquarters in London and New York, Fitch Group is owned by Hearst. For additional information, please visit fitchratings.com.

Contacts

For Media Inquiries:

Giovanni Berber

giovanni@dv01.co

Anne Wilhelm

anne.wilhelm@thefitchgroup.com