Research

Performance Report: Consumer Unsecured and Subprime Auto, June 2025

28 July 2025

Quick Insights

Unsecured Personal Loan Borrowers Prove Resilient Again

30+ impairments declined 17 bps, outperforming seasonality for the second consecutive month

Cure rates set a new record, while Made Payment rates hovered near peak levels

2024 vintages now exceed pre-COVID performance when evaluated by original balance

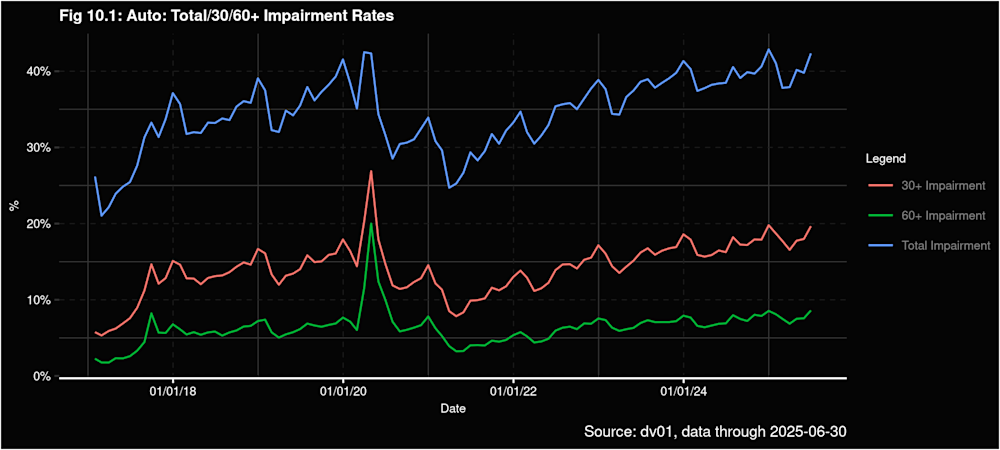

Subprime Auto Enters Uncharted Territory

30+ impairments surged 170 bps MoM, the largest single-month June spike ever

Cure rates hit a record low, while Made Payment rates suggest partial payment behavior

Loss severities climbed again, now 900+ bps above 2019 despite elevated vehicle values

Student Loans Struggle to Normalize Post-Forbearance

37% of balances in repayment are now 30+ days delinquent, triple pre-COVID levels and the highest on record

Delinquencies are concentrated in 90+ day buckets, highlighting a lack of resolution tools or discharge mechanisms

IDR usage is shifting structurally—loan count under IDR is rising, but balance share is falling, suggesting high-balance borrowers are refinancing out and leaving behind lower-value debt