Blog

Mitigating Risk From Going Under Water: Diving Into Mortgage Flood Insurance

3 August 2022

Diving Into Flood Insurance

While some financial market participants are reluctant to embrace the sustainable investing movement, others have recognized that climate risk is a major component of financial risk. Regulators are beginning to side with ESG professionals, mandating climate-related disclosures. Most of the changes have focused on equities and corporate credit, but structured credit markets are not immune to these risks. As climate change continues to produce stronger and more frequent weather disasters, it is imperative for structured credit investors to understand the risks embedded within their portfolios.

Flood Insurance Offers Minimal Protection

Floods are the costliest natural disasters in the U.S., totaling $850 billion since 2000 according to the NOAA National Centers for Environmental Information. Over the past several decades, the cost of floods has increased, accelerating the need for investors to assess and mitigate those risks. In addition, costs are projected to rise due to the combination of climate change and continued development and urbanization across the country.

Flood insurance requirements and federal agencies (e.g. FEMA) cause RMBS investors to dismiss flood risk as inconsequential, but those programs are not the panacea that many investors think.

To start, it can take FEMA up to 18 months (if not longer) to update flood maps, and Special Flood Hazard Areas (“SFHA”) may not reflect current risks by the time they’re amended. In fact, RiskFactor estimates that 75% of flood maps are out of date and 40% of the country hasn’t been mapped. Additionally, the National Flood Insurance Program (“NFIP”) offers limited protection: coverage is equal to the lesser of the maximum coverage ($250,000), the outstanding principal balance of the loan, or the value of the structure. Furthermore, NFIP promotes two common misconceptions among borrowers:

Properties outside of SFHAs do not have flood risk.

The risk is uniform across SFHAs.

In reality, some of the most severe storms, including Katrina, Ike, Sandy, and Harvey all led to flooding beyond SFHAs and generated flood depths greater than expected. For homeowners without flood insurance, the primary source of recovery is a loan from the Small Business Administration. While governors can declare a state of emergency, which triggers FEMA to assist in the recovery, FEMA funds are not a substitute for flood insurance, nor are they meant to be. For example, through its Individuals and Household program, FEMA offers funds intended to cover the most basic needs with limits of $30,000—but they average a few thousand dollars. For a storm as devastating as Harvey, FEMA funds averaged $8,900, while NFIP payouts averaged $117,000.

The perception that homes outside of SFHAs are not prone to flooding likely contributes to low levels of flood insurance across the country, with the University of Pennsylvania’s Wharton Risk Center estimating that only 30% of homes in the highest risk areas have coverage. However, three-quarters of the buildings damaged by rising water from Hurricanes Sandy, Irma, and Harvey were uninsured.

Tracking Hurricane Harvey’s Path in Fannie Mae’s Portfolio

When Hurricane Harvey hit the Houston area in August 2017, it caused $125 billion in damages, second only to Katrina. After Harvey, the NFIP paid 76,200 flood claims totaling $9 billion, but most residents were not insured against flood damage because they lived outside of SFHAs.

Fannie Mae’s portfolio sustained negative credit performance after the storm; unsurprisingly, mostly among homes with severe damage and no flood insurance. In the short-term, compared to homes with no damage, the odds of a 90-day delinquency for moderately to severely damaged homes jumped by three times for homes inside and outside the SFHA. The impact inside the SFHA is likely from a lag in receiving insurance proceeds.

In the long-term, homes with moderate to severe damage saw the probability of default increase 2.6x compared to homes with no damage. The results were statistically significant outside SFHAs but not inside. Homes outside of SFHAs were also more likely to receive modifications, which brings the loan current and lowers the probability of default.

The impact of weather-related risk does not stop at credit considerations but extends to prepayments as well. Inside SFHAs, Fannie Mae found that the odds of prepayment were 2.1x higher for moderately to severely damaged homes compared to homes with no damage. There was no significant prepayment acceleration outside SFHAs.

Flood Preparedness with dv01 Data

Given the impact on both prepayments and credit, it is essential for investors to understand weather-related risks within their structured credit portfolios. dv01 can provide detailed data on a wide range of weather-related risks powered by the National Risk Index (“NRI”). The NRI was developed as a baseline risk assessment and uses expected annual losses associated with 18 natural hazards along with the vulnerability and resilience of communities.

Importantly, the NRI flood risk does not replicate SFHAs, but instead applies a flood risk rating for the county or census tract depending on data availability. This broader geographic area will identify communities that are susceptible to floods that may not require flood insurance, exposing investors to the risks outlined above. The larger geography also adds a level of safety due to the potential for inaccurate and stale SFHA designations, giving investors a broader understanding of risks embedded within securitizations and whole loan portfolios.

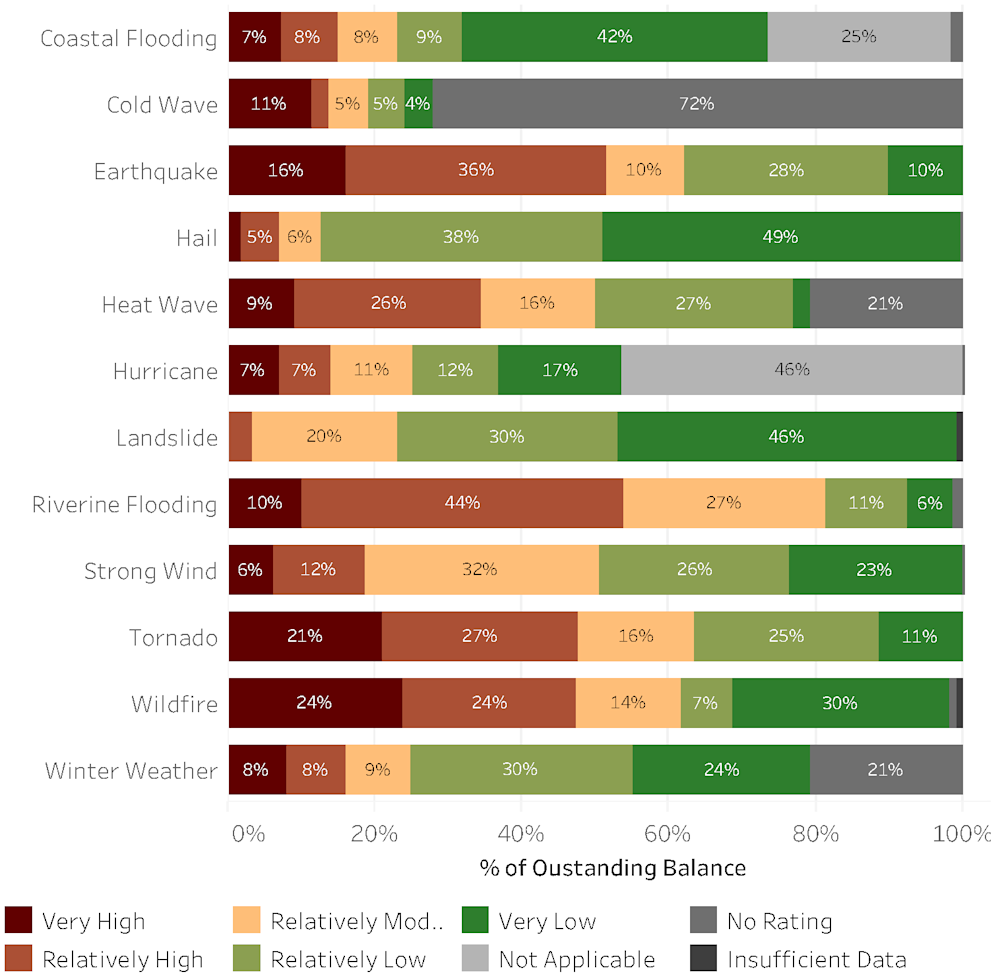

Figure 1: Environmental Risk Factor Breakdown (dv01 Non-QM Benchmark)

dv01’s latest ESG research found that 14% of the non-QM market are exposed to Very High and Relatively High hurricane risk, per NRI data. In addition, 15% of homes are in areas with Very High and Relatively High coastal flood risk and 54% are in Very High and Relatively High riverine flood risk.

While it is clear that floods will continue to impact the mortgage market in a variety of ways, dv01 can also provide risks associated with several weather-related risks, which will plague investment portfolios as climate change continues and potentially accelerates.