Blog

The Risk of Siloed Systems: What’s at Stake Without Connected Infrastructure

12 May 2025

About this Series

In this series, we’re exploring the hidden risks of relying on fragmented workflows, outdated infrastructure, or emerging vendors without the proven expertise—and what’s at stake if they’re left unaddressed. Whether you're an originator managing growing loan volume, an issuer preparing complex transactions, or an investor monitoring portfolio performance, these are the challenges that quietly build over time—and the risks worth solving for.

The Risk of Siloed Systems: What’s at Stake Without Connected Infrastructure

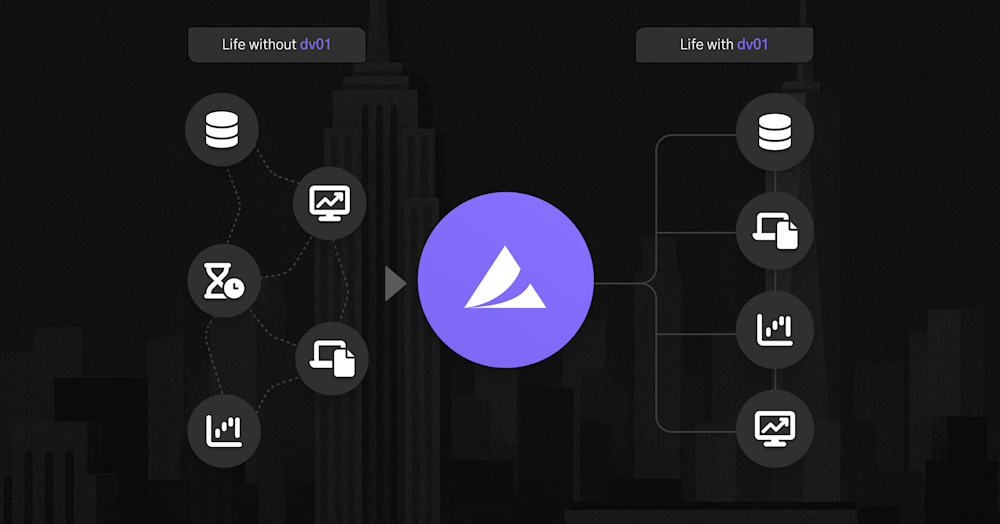

Most financial institutions don’t wake up one morning and realize their processes are fragmented. It happens gradually: a new system here, a manual workaround there, a critical report maintained in a spreadsheet by a single team member. Over time, the workflow becomes a patchwork of tools, people, and processes—and while it may function, it comes at a cost.

When your capital markets operations run across multiple disconnected platforms, the risk isn’t just inefficiency. It’s the slow, quiet erosion of accuracy, transparency, and speed at every stage of the loan lifecycle.

What Fragmentation Looks Like in Practice

Data flowing from one system to the next, with no guarantee that it stays clean or consistent along the way.

Analysts spending hours reconciling tapes, reformatting reports, or troubleshooting discrepancies.

Market insights and performance analysis are delayed by the time it takes to prep data, rather than act on it.

Disjointed reporting where information lives in different places depending on the audience—investors, trustees, internal stakeholders.

Why This Matters

Capital markets move quickly. Opportunities don’t wait for you to clean up a messy tape or resolve an internal data mismatch. Investors expect accurate, real-time insights. Lenders expect timely, precise reporting. And as portfolios scale, these small cracks widen—turning what was once “good enough” into a growing liability.

The dv01 Difference

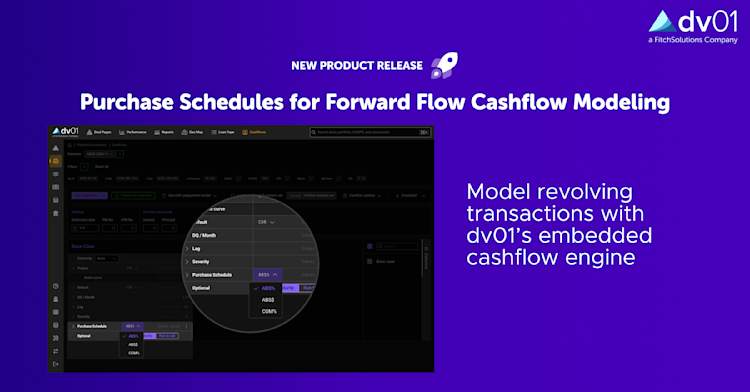

dv01 replaces the patchwork with connected infrastructure. One platform to manage your data, power your analytics, and execute your reporting—without the handoffs, gaps, or manual intervention that slow you down.

Data stays clean, validated, and consistent from ingestion through execution.

Analysis is embedded into your workflow, so you’re not waiting to act.

Reporting is centralized, automated, and investor-ready.

When your foundation is connected, you don’t just move faster—you move smarter, with confidence that your data, insights, and operations are working in sync.

Looking to Eliminate Fragmentation?

dv01’s connected infrastructure helps you replace manual processes and disjointed systems with a single, reliable platform—so your data, insights, and reporting stay consistent from start to finish. Contact us to see how we can support your full capital markets workflow.

RELATED POSTS

What Verification Really Means (and What It Doesn’t)

4 December 2025