Research

Performance Report: Consumer Unsecured, July 2025

18 August 2025

July Update: Consumer Unsecured Outperforms Seasonal Trends, TransUnion Data Shows Slower Credit Growth, Federal Reserve Points to Younger Borrower Prudence

Our latest performance report is now available.

Quick Insights

Consumer Unsecured: Borrowers Continue to Manage Through Seasonal Pressures

30+ Impairments rose just 7 bps MoM, smaller than seasonal trends

Net charge-offs held at 0.65%, materially outperforming historical seasonal norms

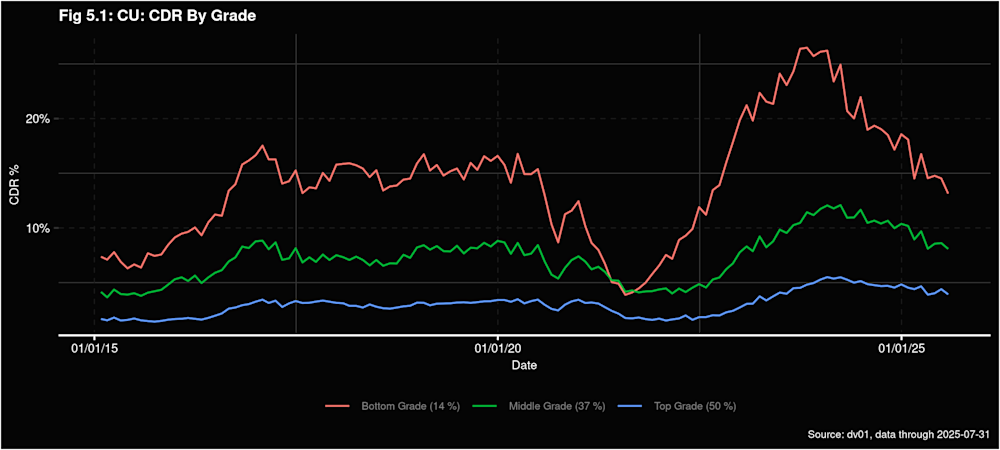

Divergence by grade: Top Grades show sharpest declines in charge-offs, Middle Grades remain above pre-COVID level

TransUnion Data: Auto Outperforms, Credit Growth Slows Further

Auto loans continue to materially outperform credit cards on delinquencies

Georgia and Louisiana lead performance, while Oklahoma, Utah, and the Dakotas lag

Credit limit growth remains muted (+0.3% YoY in June, the slowest on record)

Federal Reserve Data: Younger Households Rein in Debt

Total credit balances rose $185B in Q2-2025, but non-mortgage growth remains flat vs. pre-COVID

Households aged 18–29 saw balances decline for the fifth straight quarter; 30–39 households now flat-to-lower on a per-household basis

Younger borrowers are carrying substantially less debt, with credit card growth slower than all other age cohorts

RELATED POSTS

Performance Report: Subprime Auto, January 2026

27 February 2026

Performance Report: Consumer Unsecured, January 2026

19 February 2026