private-credit

Scaling Structure to Private ABS: How Insurance Capital Managers Use 4(a)(2) Deals—and Why dv01 Is Core to the Process

2 June 2025

As capital markets evolve, managers of insurance capital are playing an increasingly active role in structuring and investing in private securitizations. A key enabler of this shift is Section 4(a)(2) of the Securities Act, which allows for the private placement of asset-backed securities outside the public markets. These privately negotiated transactions—often executed as forward flow agreements—offer customization and control and can prove to be a strong fit for insurers' investment strategies.

But with flexibility comes complexity. And while 4(a)(2) deals offer tailored structures and attractive yields, they also demand infrastructure that can deliver transparency, performance data, and control—without the friction of traditional processes.

What Is a 4(a)(2) Securitization?

Section 4(a)(2) provides an exemption from SEC registration for securities offerings that do not involve a public offering. In structured finance, this exemption is commonly used for private ABS transactions, where asset-backed notes are sold directly to a small number of institutional investors — most often insurance companies or asset managers.

These transactions are typically:

Privately negotiated, often structured as bi-lateral trades

Custom structured to meet specific investor objectives

Backed by similar collateral to traditional securitizations (e.g., personal loans, solar loans, or auto receivables).

Why Insurance Capital Managers Favor This Approach

Insurance companies are natural buyers of 4(a)(2) securitizations — and increasingly, they're helping shape them. Here's why this structure is so well-aligned with insurer mandates:

Market Efficiency: Compared to traditional warehouse lines often used for loan accumulation, 4(a)(2) securitizations can offer more favorable leverage and financing costs due to increased liquidity while maintaining the flexibility of single-counterparty structures.

Customization: Insurers can negotiate and structure terms that align with their liability profiles — from amortization schedules to credit enhancements and triggers.

Yield Advantage: 4(a)(2) deals typically offer a modest yield premium over comparable public ABS, compensating for reduced liquidity and higher complexity.

Buy-and-Hold Match: With a long investment horizon, insurers prefer assets that deliver predictable, contractual cashflows.

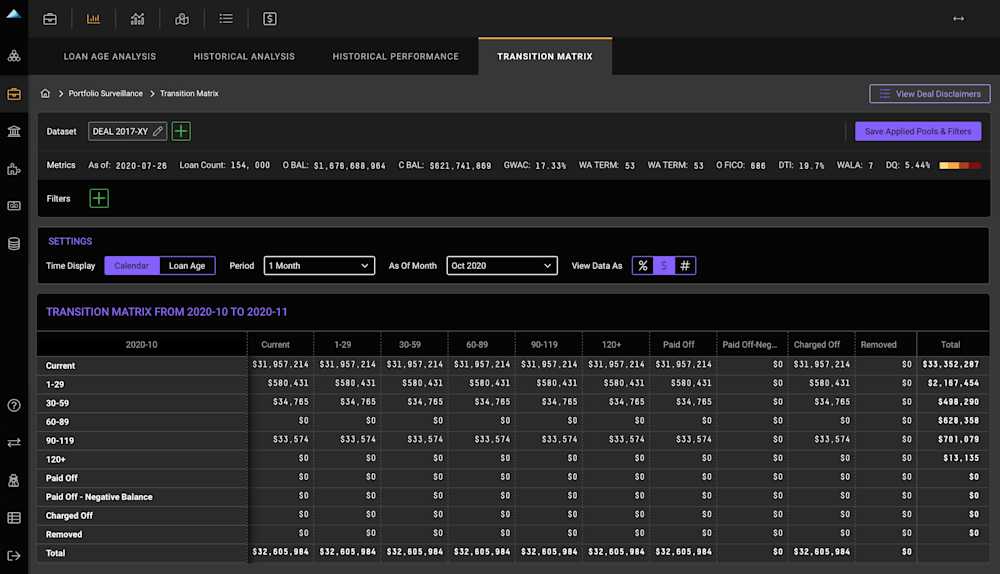

Transparency on Their Terms: In private deals, insurers can negotiate more detailed performance reporting, with monthly updates at the loan level—a key differentiator from trustee-only reports in public deals.

A Quiet Shift in Deal Structure

In many 4(a)(2) transactions, insurance companies are not just passive investors — they’re playing a more active role in shaping the deal. These private ABS transactions are often structured around a single buyer’s objectives, with tailored terms, negotiated reporting requirements, and long-term alignment.

To make this model scalable, investors and issuers alike need infrastructure that can standardize messy tapes, power custom reporting, and monitor performance over time—all without building from scratch for every deal.

Where dv01 Fits In

Private deals don’t come with standardized trustee reports or EDGAR filings. Furthermore, as the NAIC introduces more oversight—including the Principles-Based Bond Definition (“PBBD”)—insurers face growing pressure to justify bond treatment, credit quality, and capital efficiency.

As an end-to-end platform, dv01 enables market participants to streamline their workflows and reduce data management and reporting friction with a unified solution—all while maintaining the flexibility and customization that make 4(a)(2) deals attractive.

Here’s how brings structure to private structures:

Loan Pool Evaluation: Leverage dv01 benchmark datasets to identify comparable pools based on your credit box and run pre-trade assumptions to project cashflows and stress-test performance.

Deal Structuring: Upload your loan data, define eligibility rules, model waterfall structures, and run pre-close cashflow scenarios.

Asset Management & Performance Reporting: Leverage dv01’s managed data infrastructure to access clean, standardized loan-level data; generate custom performance reports; offload securitization and warehouse reporting to dv01; monitor collateral trends and performance metrics; and analyze realized vs. projected cashflows.

Private Securitizations Are Gaining Ground—And Data Transparency is Essential

As more insurers pursue direct exposure to consumer credit via 4(a)(2) securitizations, the demand for modern, digital infrastructure will only grow.

dv01 ensures that the process—from diligence to monitoring—is transparent, standardized, and scalable. That means less time wrangling spreadsheets and more time making informed, confident investment decisions.